Lessons-Learned from Seasoned Digital Health Entrepreneurs

At VANTEC Angel Network on October 3rd, 2018

Ingenious local talent and smart money are meeting a growing and global appetite for digital health innovations. A critical mass of digital health investors and entrepreneurs are enabling Vancouver companies to reach new heights and achieve faster and greater returns.

That was the central message delivered at VANTEC’s Angel investor meeting on October 2018. A frank, lively exchange was led by Geoff Hansen, a serial entrepreneur, advisor and seasoned tech investor who has presided over 7,000 investor pitches since 1998.

“There are so many promising companies in BC. Digital health is one of the hottest tech areas for investment,” said Geoff Hansen. He kicked of a Digital Health presentation and lively panel discussion with four digital healthcare CEOs, followed by company updates, preview pitches and full presentations.

Digital Health Stars

In 2018, health information management and personal health applications are the stars. Business models are as simple as ‘pay-as-you-go’ to getting insurance companies to foot the bill for a solution that reduces the cost of healthcare delivery.

The digital health sector covers a broad range of areas that leverage technology from self-care to professional care: measuring and monitoring health and disease indicators at an individual level (e.g. DiaBits); increasing operational efficiency and clinic management (e.g. Jane’s software); and reducing overall costs for individuals and organizations (e.g. Claris Reflex).

Go Global Faster

Digital health is a fluid, dynamic sector that leverages technology to identify, qualify and penetrate global markets.

“Our market is huge,” said Alexandra Greenhill, co-founder and CEO, Careteam and myBestHelper. “We can die on the vine trying to conquer various provinces in Canada” or we can pursue global markets and rapidly find new customers in other countries and increase our valuation. I believe in “Go Global Faster”.

Family Origins, Global Markets

The origin of many digital health startups often stems from a family member or dear friend affected by a disease or chronic healthcare condition. People are often incredulous at the barriers and challenges a person has to go through to achieve better health outcomes. “There has to be a better way,” is often the mantra of a passionate, newly-minted or seasoned entrepreneur.

Established companies continuously scan their customers’ needs and frustrations to develop new products with significant market potential and adoption. (i.e., QLT’s widely-successful drug for macular degeneration arose from a mom’s concern about improving her vision). QLT built a powerhouse company with a global footprint by listening to its customers and acting swiftly in response to their needs.

Rapid Growth, Complexity

A decade ago, a digital health company had a slow ramp-up time to get to critical mass, but now when they understand the nature of digital technology, they get to grow very quickly, said Hansen.

“I want to inform our investment community about the tremendous opportunities for growth.” He believes it is an “interesting sector” with complexity regarding product development, financing options and strategic partners for growth and exit.

Indeed, a digital health company is not a typical technology company. It’s a complex blend of health and high tech dynamics that can accelerate growth (and exit options) through rapid market penetration, customer adoption and scale.

“It is something that is complicated - like a life sciences company. It is something that you have to prove yourself - like a cleantech company,” said Hansen. “Digital health companies tend to grow fast - like a software company.”

Healthy Returns @ Scale

Investment in the digital health sector is skyrocketing, driven by angel investors and aggressive corporate venture capital companies (CVCs) for example Telus Ventures, Samsung & US companies with deeper pockets, cross-sector expertise and valuable connections and partnerships in Canada, the US and globally.

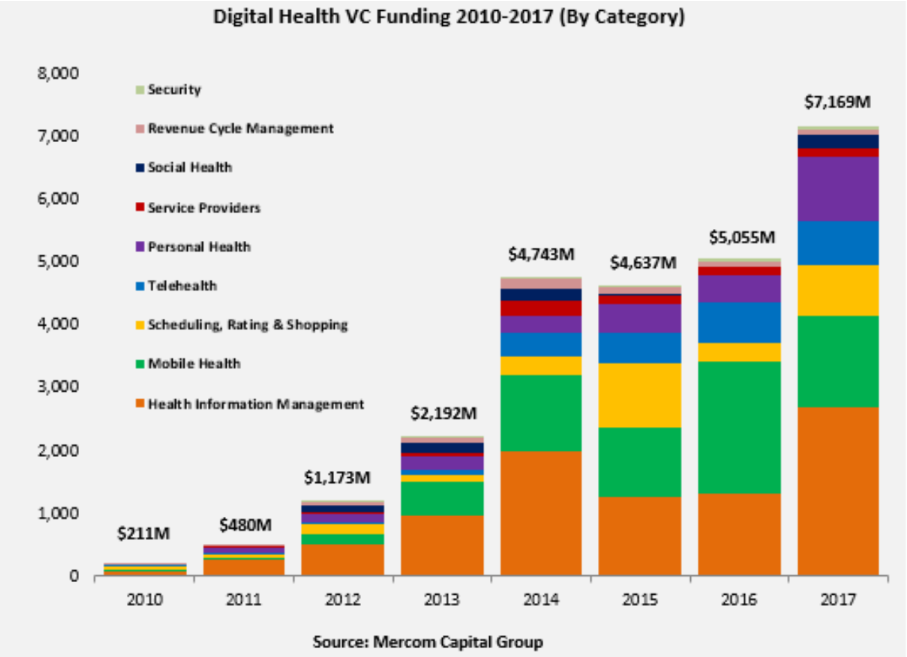

The digital health market accelerated in 2014, with $7B of investment in 2017 and is on track for $8.5B of investment in 2018. The average time from seed to a round is 15.7 months, said Hansen. On average, digital health companies IPO after 10 years after raising $136M in venture funding.

Smart Exit Options

There’s an exciting array of exit options for investors - ranging from acquisition (i.e., big companies buying small companies); consolidation (roll-ups of related companies in a specific area); and IPOs. A strategic partnership with a corporate venture capitalist is more complex and requires greater due diligence to assess the match and overall fit. With the right expertise, there are “workarounds” to the conditions of the strategic partnership, said Hansen.

Presentation: Trends in digital health - Geoff Hansen

Panel Discussion: Digital Health Startup CEO's

Alison Taylor and Trevor Johnston Co-CEO's at Jane Software

Geof Auchinleck CEO at Claris Healthcare

Alexandra Greenhill CEO at Careteam Technologies

Watch the digital health startup investor presentation videos

The company presentation are accessible by VANTEC and Associate members only.

See the list of companies that presented

You can apply to become a member (only $500) or an associate member ($300).

Vice President, Investment

Vice President, Investment